The Indian stock market faced a turbulent session on Monday, leading to significant losses for investors. The Nifty 50, which had shown promising momentum over the past two trading sessions, experienced a sharp reversal. This abrupt downturn has brought the index back down to a crucial near-term support level of 19,500. Several factors have contributed to this market upheaval, including global cues, geopolitical events, and individual stock performance.

Impact of Global Cues and Geopolitical Tensions

The direction of the Nifty 50 has been heavily influenced by global cues, particularly due to the ongoing Israel-Palestine conflict. This conflict has shifted global market sentiment toward a risk-off mode, causing concerns among investors. As a result, the Nifty 50 retreated from its recent highs and now hovers around the 19,500 mark.

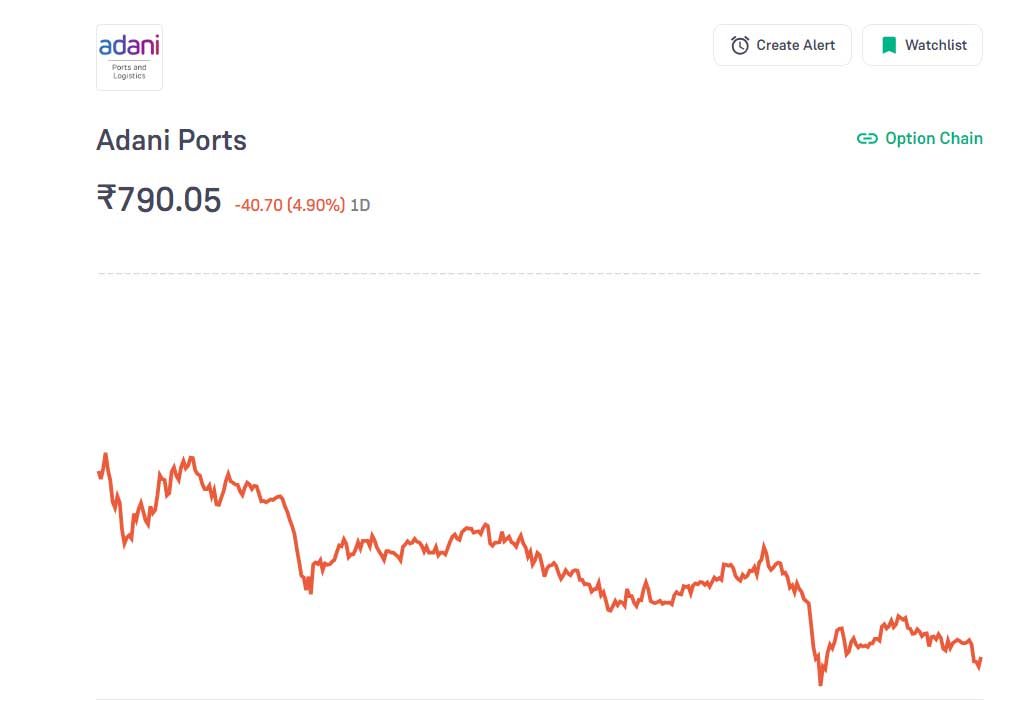

Adani Group’s Substantial Losses

Monday’s trading session saw a significant wealth erosion for investors, with over Rs 3 lakh crore lost collectively. Notably, the Adani Group bore a substantial portion of these losses, with a decline of more than Rs 34,000 crore in market capitalization. This decline was primarily driven by losses in Adani Ports and Adani Power.

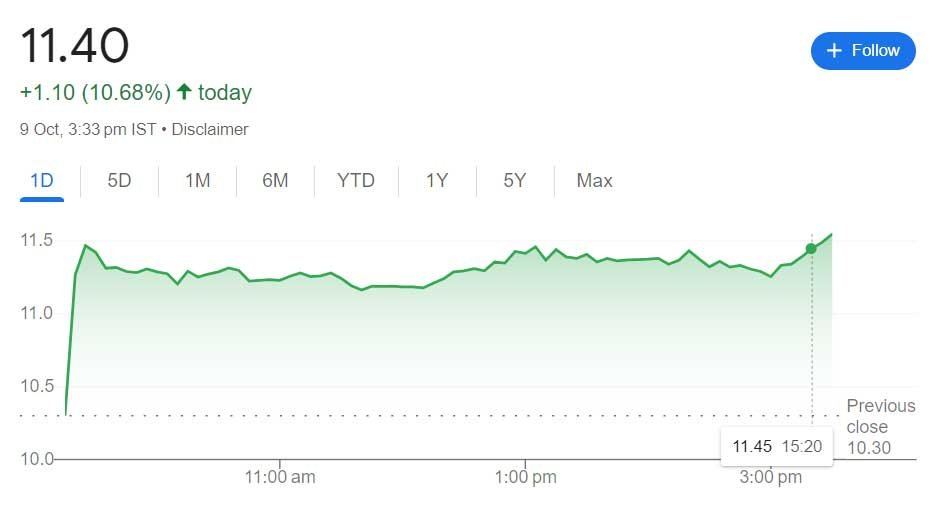

Volatility Index (VIX) Surge

Adding to the uncertainty was the India Volatility Index (VIX), which surged nearly 11% on Monday. Increased volatility often indicates a higher level of market uncertainty and can be a cause for concern among investors.

Key Contributors to the Nifty 50’s Drop

A significant portion of the Nifty 50’s decline on Monday can be attributed to key players in the Indian market, including HDFC Bank, Reliance Industries, and ICICI Bank. Among these, HDFC Bank contributed the most to the 140-point drop in the index. However, IT stocks, led by TCS and HCLTech, managed to mitigate some of the declines. TCS even ended the session at a 52-week high.

Expert Opinions on the Market Outlook

Chetan Seth of Nomura emphasized the importance of monitoring geopolitical events, particularly in the Middle East, as they can have a significant impact on Asian equities. He suggested that unless the conflict escalates further, it could ultimately present a buying opportunity for Indian stocks.

Mahesh Nandurkar of Jefferies highlighted the substantial equity supply expected in financial year 2024, which could cap the market’s near-term upside unless there is an improvement in foreign portfolio investment (FPI) flows.

Technical Analysis and Near-Term Support Levels

Chartists have identified key support and resistance levels for the Nifty 50:

- Shrikant Chouhan of Kotak Securities noted that the intraday market texture is non-directional, awaiting a breakout. Key support lies at 19,480, while resistance is at 19,605.

- Rupak De of LKP Securities believes that the Nifty sentiment will remain “sell on rise” until it surpasses the 19,700 mark. Support levels are expected near 19,480 – 19,430, with resistance at the 200-DMA of 19,670.

- Nagaraj Shetti of HDFC Securities highlighted the formation of a bullish hammer candle pattern on the weekly chart and expects the Nifty 50 to temporarily slide towards levels of 19,350 – 19,450 before experiencing an upside bounce. Immediate resistance is at 19,620.

Nifty Bank’s Performance and Key Support Levels

The Nifty Bank, which has been under pressure, managed to recover 90 points from its intraday low of 43,796, signaling the importance of the 43,800 support level. However, it remains down 2,500 points from its recent high on September 15.

According to LKP Securities’ De, as long as the Nifty Bank remains below the critical 44,000 level, weakness may persist in the short term. Immediate support is at 43,800, with resistance at 44,000, prompting traders to consider selling.

Adani Ports in Focus

Adani Ports emerged as the top loser on the Nifty 50 index, with a decline of over 5%. This marked its most significant drop in the last six months, causing a loss of over Rs 8,500 crore in market capitalization. The decline was attributed to the Israel-Palestine war, as Adani Ports owns and operates the Haifa port in Israel.

Market expert Anand Tandon highlighted the strong position of Adani Ports within India and the region but cautioned investors to monitor global geopolitical developments before making immediate investment decisions.

As the market navigates through uncertain times, investors are advised to exercise caution, stay informed about global events, and consider the insights of experts to make informed decisions. The Nifty 50’s direction remains sensitive to global cues and earnings reports, making each trading day a crucial one for investors.

About Web Solution Centre

Web Solution Centre is a highly reputable web design and digital marketing agency known for its excellence in providing top-notch services to businesses of all sizes. With years of experience in the industry, Web Solution Centre has firmly established itself as a trusted partner for those seeking to enhance their online presence, elevate their brand image, and achieve digital success.

Specializing in a wide array of services, including website design and development, e-commerce solutions, search engine optimization (SEO), and social media marketing, Web Solution Centre’s team of skilled professionals is dedicated to crafting visually captivating and user-friendly websites tailored to meet each client’s unique needs and objectives.

Web Solution Centre’s commitment to innovation and staying at the forefront of industry trends ensures that clients receive cutting-edge solutions to stay competitive in today’s dynamic digital landscape. Their client-centric approach, attention to detail, and focus on delivering measurable results have earned them an esteemed reputation in the industry.

Whether you’re a startup looking to establish your online presence or an established business seeking to revamp your digital strategy, Web Solution Centre offers the expertise and solutions to help you achieve your goals. Their impressive portfolio of successful projects and satisfied clients speaks to their unwavering dedication to excellence in web design and digital marketing.

With a strong emphasis on customer satisfaction and a proven track record of delivering exceptional results, Web Solution Centre continues to be the preferred choice for businesses seeking reliable web solutions and digital marketing services. Their expertise and commitment to excellence make them a valuable asset in today’s ever-evolving digital landscape.

Leave a Reply